Federal Tax Credit Nissan Leaf 2019

The credit amount will vary based on the capacity of the battery used to power the vehicle. Buyers are still eligible for a 7500 federal tax.

2013 Nissan Leaf 75 Mile Range Anticipated In New Test By Epa

For comparison the least expensive Tesla vehicle the Model 3 starts at 37990.

Federal tax credit nissan leaf 2019. A credit of 7500 taken off her federal taxes. See for yourself. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Here are the prices the starting MSRPs with the 7500 credit applied. From October 2019 to March 2020 the credit drops to 1875. She settled on a brand-new 40000 Nissan Leaf a birthday present to herself because it came with an incentive.

With its larger battery and more power new 2019 Nissan Leaf Plus starts at 36550 for the S model 38510 for the SV and 42550 for the SL. Like a return on an investment shoppers who buy this 29000 car can get a 7500 federal tax credit. LEAF Plus S 30700.

From April 2019 qualifying vehicles are only worth 3750 in tax credits. After that the credit phases out completely. Federal EV Tax Credit Phase Out Tracker By Automaker Updated through June 2020 Consumers analysts electric vehicle advocates lawmakers and others are all curious about what will happen to the growth in EV sales when the US Federal EV tax credit phases out.

Explore the 2021 Nissan LEAF EV benefits including potential tax credits environmental benefits of zero-emission driving with performance features like 100 torque off the line and instant acceleration. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax research analyst at The Tax Institute. If you owed 10000 in federal income tax.

The Model 3 is also ineligible for the federal tax credit. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. LEAF Plus SV 32250.

The 2019 Nissan Leaf has managed to maintain its full credit status. LEAF SV 26690. Homepage Research Buyers and Sellers Advice EVs Remaining Eligible For The Full Federal Tax Credit Through 2019 Not all electrified models will be subject to the full 7500 credit this year.

A Rechargeable External Source According to the IRS website the vehicle must have a 4 kwh battery or greater and it must be rechargeable by an external source. But Mueller was in for a nasty. More In Forms and Instructions.

Federal Tax Credit Up To 7500. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles.

An additional 417 is allowed for the first 5. Some hybrid electric vehicles have smaller batteries and dont quality for. If youre in the market for a new electric vehicle based largely on the one-time 7500 federal tax credit enacted in 2010 to spur sales of battery-powered rides youll find your choices narrowing this year.

Nissans announcement of the. XC40 Recharge Pure Electric P8 AWD. State andor local incentives may also apply.

A tax credit of up to 7500 is allowed for the purchase of a new qualified plug in electric drive motor vehicle that is placed in service. Thats before any government. An amount of 2500 is allowed per vehicle.

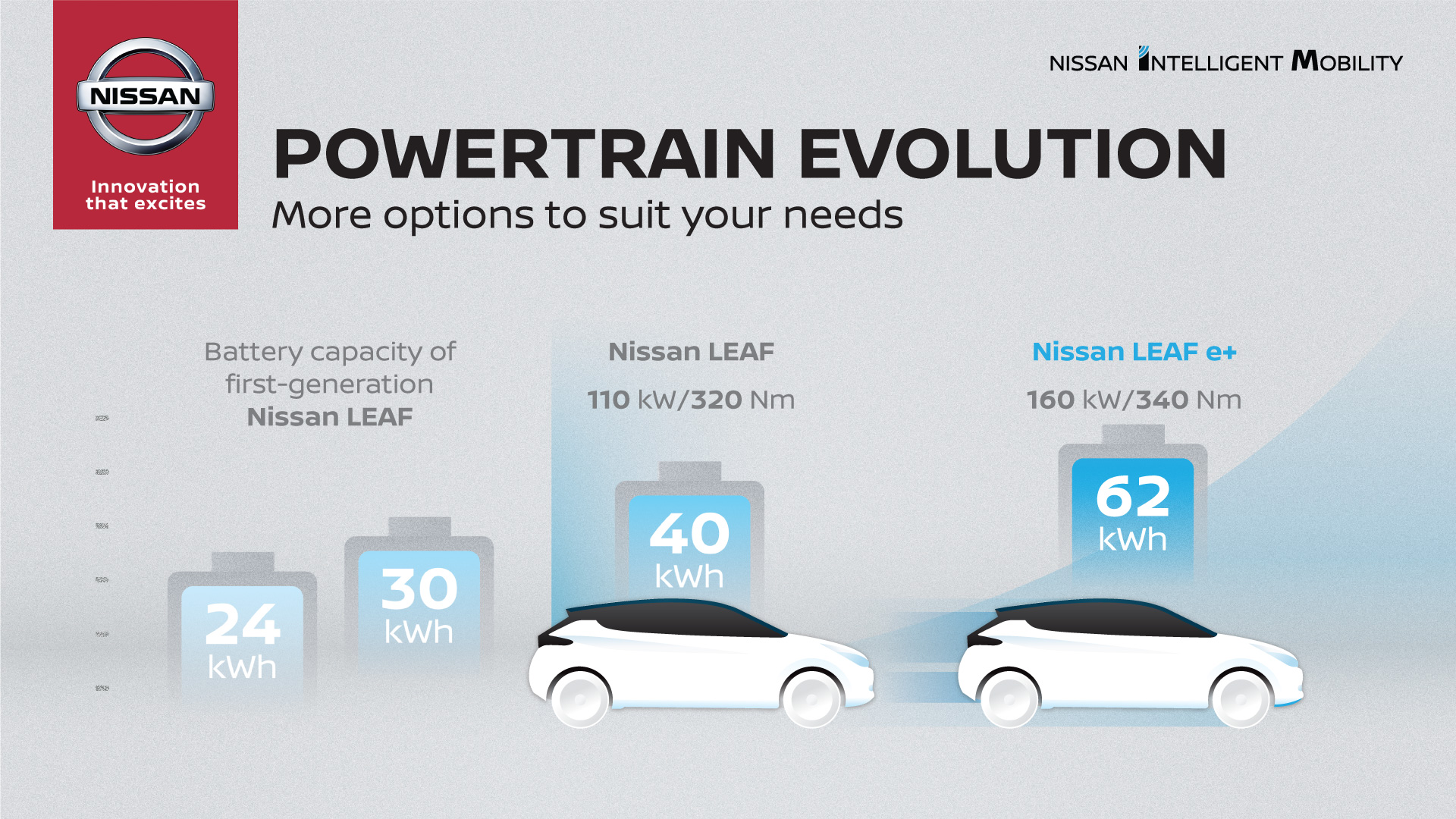

The amount of the tax credit ranges from 2500 to 7500 depending on the size of your battery. LEAF S 24100. For example if you owned a Nissan LEAF and owed say 3500 in income tax this year then that is the federal tax credit you would receive.

LEAF Plus SL 36400. Nissan buyers are still eligible for the full 7500 federal EV tax credit which pulls the Leaf S Plus effective price to 28050 and the Leaf SL Plus to 35050. The Leaf S Leaf SV and Leaf SL will cost 30885 33385 and 37095 including an 895 destination charge.

Nissan is expected to be the third manufacturer to hit the limit but as of this writing its still 70000 sales away from this.

2018 Nissan Leaf 150 Mile Range 29 900 After Federal Tax Credit Nissan Leaf Nissan Electric Cars

Us Nissan Leaf Sales Improved Almost 50 In Q1 2021

How To Charge Your 2020 Nissan Leaf Evmatch

Why Does Nissan Leaf Depreciate So Much Provscons

Amazon Com 2016 Nissan Leaf S Reviews Images And Specs Vehicles

2021 Nissan Leaf Features Specs In Peoria Serving Phoenix Az

Nissan Leaf Lease And Payment Offers Woburn Ma

2021 Nissan Leaf Prices Reviews Vehicle Overview Carsdirect

2021 Nissan Leaf Lowest Cost To Own Among Electric Vehicles Kelley Blue Book

Nissan Leaf Gets Award For Cheapest Electric Car To Own

2021 Nissan Leaf Hatchback Falls Into New Electric Crossover Suv Eminetra

Nissan Leaf Price Reviews Features Etc Electrek

2020 Nissan Leaf Prices Reviews Pictures U S News World Report

Nissan Leaf Price Reviews Features Etc Electrek

Amazon Com 2017 Nissan Leaf S Reviews Images And Specs Vehicles

2020 Nissan Leaf Review More Mainstream The Torque Report

2019 Nissan Leaf Review Ratings Specs Prices And Photos The Car Connection

How I Got A New 2015 Nissan Leaf Electric Car For 16k Net Indecision

2020 Leaf Special Pricing Clean Charge Network

Post a Comment for "Federal Tax Credit Nissan Leaf 2019"